tv Nightly Business Report PBS January 14, 2013 4:30pm-5:00pm PST

4:31 pm

captioning sponsored by wpbt >> this is n.b.r. >> susie: good evening everyone. i'm susie gharib. president obama tells congress we're not a deadbeat nation, and they need to raise the debt ceiling now, so we can pay our bills on time. >> tom: i'm tom hudson. a sour day for apple investors. the stock tumbles to 11 month lows on new worries about waning demand for the iphone 5. >> susie: but a banner day for g.m., the cadillac ats takes car

4:32 pm

of the year at the big auto show in detroit, and its new corvette stingray wows gear heads around the globe. >> tom: that and more tonight on "n.b.r."! >> susie: the next big fight in washington has begun. president obama today called on republican lawmakers to authorize an increase in the nations debt limit, saying that messing with it could potentially have catastrophic results for many americans and the overall economy. he warned markets would go haywire if congress does not act, interest rates would rise, and checks to social security beneficiaries would stop. and he said even thinking about the u.s. not paying its bills is irresponsible and, "absurd". darren gersh reports. >> reporter: in his first news conference of the new year the president gave a harsh lecture to republicans about the need to raise the debt ceiling and he once again said there was no way he'd negotiate with congress about something it should do

4:33 pm

anyway. >> they will not collect a ransom in exchange for not crashing the american economy. the financial well-being of the american people is not leverage to be used. the full faith and credit of the united states of america is not a bargaining chip. >> reporter: republicans called the president hypocritical for saying he will not negotiate over the debt limit while blasting republicans for refusing to negotiate. and they fired back that the debate over the debt ceiling was the perfect time to consider legislation to cut spending. at the same time, only a handful of republicans have actually said they'd let the united states default on its bills. >> t predent claims this, but republicans have always raised the debt ceiling. we've never seen the debt limit fail to be raised. all they have said is we want to apply the same criteria that the president himself applied when he was a senator and say we don't want to give the president a blank check. we would like to fix the substantive problem which is the level and the growth in the debt. >> reporter: markets are almost treating the fight over the debt ceiling as the sequel to a bad movie.

4:34 pm

and investors have a pretty good feel for how this cliffhanger ends. >> they don't really care about the brinksmanship until they are right up to the brink, but also, the more dangerous the fall, off the brink, they figure the less likely tt it going to happen. >> reporter: treasury secretary timothy geithner told congress today that unless it acts, the nation will not be able to pay its bills sometime around mid- february or early march. so with a month of so to go, there is no solution in sight. darren gersh, washington, d.c. >> tom: federal reserve chairman ben bernanke echoed the president's comments on the debt ceiling today, in a speech at the university of michigan, he said congress has to take action to avoid a situation where our governme doesn't pay its bills. ahead of that, stocks were mixed, the blue chip dow rose almost 19 points, while the nasdaq dropped eight, and the s&p 500 down a point. >> susie: weighing on the nasdaq today: apple. the stock got crushed, on word demand for the iphone 5 is

4:35 pm

slipping. the stock closed just shy of $502, losing almost 4%. in pre-market trading the shares briefly fell below $500, the first time in nearly a year. suzanne pratt reports. >> reporter: apple has been taking a big bruising. first, it was the earnings miss for the september quarter, the second straight. then, there's been growing speculation the tech innovator is losing its edge to competitors, particularly samsung with its popular galaxy smartphone. finally, today there were reports apple dramatically cut orders for iphone 5 components, due to weak demand. to be sure, apple has not confirmed soft sales with hard numbers. but, experts it would not surprise them if consumers were sour on iphone 5. >> it may be significant, we just came through the consumer electronics show and virtually all of the high profile phones that were introduced there had very large screens.

4:36 pm

some manufacturers like samsung have done very well with screens that are five inches or more in size. the iphone 5 is a four inch screen. >> reporter: apple is still far more profitable than any other consumers electronics firm in the world. but, analyst's celestial expectations have led to a crushing fall for apple shares. since hitting a high of $705 in september, the stock has lost nearly 30%. the selloff has trigged a big debate on wall street. are the shares cheap enough to buy, or is the market darling done? apple bulls argue the gadget maker has a p.e. of just 11. apple bears say the company's days as a fast growth giant are over. for investors on the fence, it may make sense to wait until apple releases it latest quarterly results next wednesday. some experts are speculating apple will fall short on revenues, because of weak ipad demand. >> in the tablet world you've certainly seen the android

4:37 pm

tablets get more of a foothold into the tablet market, a market that was almost entirely apple's for quite a while. >> reporter: if apple doesn't have enough troubles, here's potentially one more headache. rim is due to release its much awaited blackberry 10 later this month. and, so far it seems the reviews are generally positive. suzanne pratt, "n.b.r.," new york. >> susie: dell stock also making news today, on reports the company is in talks with private equity firms regarding a potential buyout. investors snapped up the stock: dell shares posted their best day in months, rising 13% to $12.29 a share. dell had no comment on the report. >> tom: still ahead, tonight's word on the street: facebook. the social network promises a mystery announcement tomorrow, how friendly could that be for shareholders? >> susie: stocks are up so far this year, but adam parker expects the markets will close flat for 2013.

4:38 pm

he's chief u.s. equity strategist at morgan stanley. so adam why so gloomy so, many strategists are much more positive than you are. what is your thinking? >> well, look, we have a more cautious earnings outlook than i think some of our peers. the macroeconomy is not that strong right now. and corporate earnings aren't growing that much. i think that is the root of our near-term caution. >> susie: on earnings also you're not so upbeat. are you looking for them to be flat-to-down 1%, again conscientious. up 11 percent. the distect-- disconnect? >> look, i'm pretty certain the conscientious estimates are too high this he have been too shy for a year now. we saw the worst quarter in the third quarter this cycle on the revenue side. and i think that will continue. i think the question isn't are the consensus earnings too high t is will the stock market care. because the last year the s&p total returns basically now is right near its all-time high even as the earnings have come down.

4:39 pm

so it's not about are the earnings too high or not, they are. it's about will anybody care as they decline sudz well, one thing that investors cared a lot about today was apple. you heard our story on that i know you can't speak specifically about the stock. but are you also not a fan, a real fan of technology. why not? >> well, look, we look at a few things when we make our recommendations, susie. we look at the the achieve ability. are the estimates achievable. i think for tech it is tough right now. a lot of the conditions in the economy are slow. it spending is to the really that great. so i don't know if the estimates are that achievable. i also think that yeah, better risk/reward in other sectors in the market. we're trying to advise our clients how to outperform the s&p. i think there is better opportuniy. within tech there are some things we like where recommending suck stocks for example. i think that is one economically sensitive area that the stocks haven't participated that much in the rally. >> susie: let's talk about the areas that have been telling your clients, morgan

4:40 pm

stanley clients which direction to go. you have three big themes for your clients. buy stocks with from american companies with exposure to china, positive on china. buy dividend paying stocks and you like very large stocks, what you call megastocks. why are these the themes for you? >> well, look, for china i think we identified late last fall that the u.s. companies with china exposure had really lagged the broader market and had gotten quite cheap. and the china economy started to stabilize a little, we thought that was good risk/reward. on the dividend theme i think our call was that the tax rate wasn't going to rise the way it was written in the law. we have seen that and this is a pretty compelling group of stocks. you have low payout and bond rates are low so you can buy dividend stocks that yield well relative total attorney difficults in the bond market. on the megacap stocks you have a lot of large high quality american companies that should be able to grow at or higher than the rate of the market or cheaper than the market and also have those higher dividends.

4:41 pm

>> susie: and the other two sectors that you also recommend to your morgan stanley clients, health care, companies like cardinal health, and industrials like honeywell, general motors what is the story there? >> well, for health care look, when you want to be a little defensive in the markets's natural for people to think about two sectors, health care and staples. we really like health care more than staples right now. we see that pretty clearly. health-care companies are beating estimates more, they have higher cash balances and you know they are much cheaper. they really never have been cheaper on forward earnings relative to staples so we really like that overweight health quarter underweight staples call. as for industrials you have a lot of high quality u.s. companies. some have the china exposure. others benefit from energy and infrastructure or improvement in housing so it seemed like there were fundamental reasons to be more optimistic on that group of stocks. >> susie: okay. well, we'll see how it goes this year. thanks for coming on the program. we've been speaking with

4:42 pm

adam pozen. >> susie: it's not easy being a retailer these days, especially if you rely on customers buying at your store. many consumers come in and browse, but make their purchases online. but tech innovations are helping to change that. erika miller got a sneak peek at the intel booth at the national retail federation's convention. >> reporter: adidas had a problem. that's the company most americans call "adidas". it needed to figure out how to get customers to buy merchandise in its stores, instead of on- line for less.

4:43 pm

it found the answer in this interactive display, which has boosted traffic, and dollars spent per transaction. >> normally, in a physical store you can get maybe 200 different products. but with this, you are not really limited. but rather than just put a little kiosk in the store, what we wanted was to put this wall in the store so you could tryout the products in real size. like you would in a normal store. >> reporter: mccormick is hoping to spice up sales with this interactive game, called "guess this spice," with scent that comes out. you get a coupon at the end. mccormick has another display to identify your flavor profile. i'm cocoa loco. >> in the store, now's the time you can sign up for more information about this, where we can send you recipes, our about information in the store, so we can drive more traffic to the store. >> reporter: for now, many of these machines are primarily focused on managing inventories and raising brand awareness. but down the road you will

4:44 pm

likely see more exciting features that will help companies better meet customer needs. this is a peek at pepsi's next- generation vending machine. not only does it have games, it also repairs itself. >> you can also see whether the machine is working or not. if it has some sort of glitch, it can be remotely healed. >> reporter: eventually, it may also track who buys what. >> it will be able to tell whether you or male or female and which of four age buckets you are in. it will basically know that possibly a young female in this category is the one buying diet pepsi, versus maybe a male in the senior category is the one buying the classic pepsi. >> reporter: coffee lovers may be interested in this new vending machine. it's made by costa, the second largest coffee chain in the world afr starbucks, although it's not in the u.s. the machine pumps out cafe sounds, and the faint aroma of a bakery. and it could be a ticket to new business expansion: >> this machine is far more aesthetically elegant. and the user interface is far more suitable for places like

4:45 pm

offices, hospitals, educational establishments. and possibly new international markets. >> reporter: he wouldn't say if that includes the u.s. but you have to wonder why costa would bother with this huge u.s. retail trade show, if it didn't have plan brewing. erika miller, "n.b.r.," new york. >> tom: we continue our monday series with some of the nation's top universities to bring you the best research on business, the economy and investing. we call it "nbr-u". our partners combine over 400 years of business knowledge-- harvard, stanford, wharton and vanderbilt universities. every monday we speak with top professors about key money issues. and you can read in-depth articles at: www.nbr.com, just look for the "nbr-u" tab. tonight: money market funds. from small investors to giant pension funds and big corporations: more than $2.5 trillion are in money market accounts. but, as the credit crunch illustrated, one important

4:46 pm

difference is what those funds are invested in. we spoke with robert pozen, senior lecturer at harvard business school. our money markets, i think they're relatively safe and after the crieses the sec took several actions that made them a little safer. it reduced the average maturity from 90 days to 60 days. it now requires 97 or more percent of the assets of money market funds to be highly rated. and it also imposed certain liquidity requirements so they would have enough funds to meet redemptions. >> as we learned four nears-- iers ago not all money market funds are created equal. >> s this's absolutely rightment one big division is between money market funds that invest only in treasuries and other government guaranteed securities. now historically that's been a pretty safe group of money market funds. the group of money market funds where the issues have been are called prime funds because they invest in

4:47 pm

commercial paper of various sorts of companies. >> sure. >> and so i think that we shouldn't take a broad-brush approach. we should really focus on those commercial paper or prime money market funds opinions and what are you referring to is the regulatory review of money markets trying to address some concerns that were brought up when a big prime fund broke the buck. that net asset value which traditionally has been a dollar per share for money market funds went below testimony and the regulators have said do we want a floating fund? >> right. and the regulators have proposed a number of different potential requirements. they've been very controversial am but i think the most important one is the one that you just mentioned. that instead of having a constant dollar net asset value, it would fluctuation with the market every day. now it probably wouldn't fluctuate by more than a part of a cents, of one cent but it still would fluctuate. >> we've seen money come back into money market funds

4:48 pm

over the past couple of months, what does that tell you about the confidence of those investors? >> i think the investors are getting more confident. i think the sec's new rules are helpful. they reduce the risk. and quite frankly the rates of return are not very good throughout the marketplace. >> that includes money market funds though. >> it's all a relative question as einstein said. and he was a smart guy. so money market funds have a modestly better yield than a lot of other instruments-- instruments. and they are viewed, especially government funds, and the retail investor i think is in a situation where there are lot oss of small accounts. continued it would take a huge number of accounts to really cause a problem without the fund. >> tom: a multitrillion dollar market, bob pozen with us from harvard business school. thanks, bob. >> thanks for having me.

4:49 pm

>> susie: some big wins for general motors on the first day of the north american international auto show in detroit. gm's cadillac ats took home "car of the year" honors at the show's kick-off event. the award is the latest in a string of accolades for the ats. cadillac's luxury compact sports sedan is the lightest car in its class. g.m. also unveiled its latest edition of the chevy corvette. the seventh generation model brings back the stingray nameplate, which baby-boomers will remember last from the 1970s. g.m. hopes the sleeker model will get corvette lovers to upgrade, while also attracting younger buyers. >> we also want to expand the owner base maybe to a younger

4:50 pm

audience those in their early 40's if you say who are looking to buy a sports car for the first time maybe considering a european brand and making sure that they recognize that if they want to get into this market they owe it to themselves to shop for chevrolet corvette. >> susie: truck of the year, went to the dodge ram. tomorrow night we look at the truck wars, from g.m. to dodge, and the ford f-150. truck sales are picking up thanks to the pick up in the housing market. tom, there's also the war over global market share. >> let's look at our market focus. >> tom: it was a mixed monday for the jor stock indices wh ape ighing on the broa market. the s&p 500 spent the entire session in the red but in a very narrow trading range, just six points. it finished lower by a fraction.

4:51 pm

trading volume was light on the big board with 590 million shares. just under 1.9 billion traded on the nasdaq. telecommunications saw the biggest sector loss, down 1.1%, followed by the technology sector's 0.7% loss, thanks to apple. as the biggest publicly traded company by market cap, apple exerted its influence over the market. as suzanne reported, apple stock fell after it cut orders for iphone 5 components. tonight's closing price breaks belowhe december lo taking appleack to prices it hasn't traded at since last february. the apple news hit the stocks of its suppliers. cirrus logic makes semiconductors used in iphones. shares fell 9.4%. jabil circuits makes the iphone metal casing. jabil fell 1.9%. qualcomm's wireless chips are in iphones. qualcomm stock fell 1%. but apple competitor research in motion continued its rally, moving up 10.2%, on very heavy volume. the newest blackberry is due to be launched in two weeks. just two days before it releases fourth quarter earnings, j.p. morgan was hit for the first time by regulatory actions related to last year's multi- billion dollar derivatives trading loss. the bank agreed to fix its risk management ogram,nd step up

4:52 pm

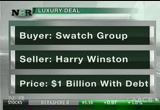

anti-money laundering procedures, as directed by the comptroller of the currency and the federal reserve. neither action included any financial penalty. shares fell 0.6%. it recently traded at a nine month high. u.p.s. won't deliver on it's plan to buy dutch package delivery company t.n.t. express, ending its $7 billion bid over regulatory objections in europe. shares rallied 1.7%. it would have been u.p.s.' biggest acquisition ever. swiss watch maker swatch group is buying the harry winston jewelry brand. it's best known for draping its diamonds on movie celebrities. swatch will pay $1 billion, $750 million of it in cash, the rest is the assumption of debt. swatch is buying h.w. holdings, the unit of harry winston which owns the brand. harry winston stock jumped 4.3% to f)-zoh at an 18 month high. swatch is not buying the

4:53 pm

company's diamond mining business. that business will be re-named dominion diamond. the incoming sears c.e.o. is increasing his stake in the company, hedge fund manager edward lampert already owns a majority of the stock, and he's bought more. it comes three weeks before lampert takes over the c.e.o. duties at sears. shares responded with a 8.9% rally. the stock is now higher than the day before lampert announced he was taking over as c.e.o. three of the five most actively traded exchange traded products were lower. the emerging markets and japan funds were higher. and that's tonight's "market focus."

4:54 pm

>> tonight's word on the street, facebook. tomorrow the social networking giant invited the media to its headquarters to announce something. we just don't know what yet. the anticipation has been enough already to push the stock over $30 per share for the first time in six months. deborah borchardt is waiting to hear what facebook has in store, a markets analyst with the street.com. in your on-line article, deb ra, you call tomorrow's announcement a red carpet moment for facebook, why? >> well, as you know, the company came public recently and it was a terrible ipo, botched all around. and it's been in a show me state ever since. and it has not impressed the market it has not impressed investors. and as a consequence the stock has traded down. and so now they made this big dole about this mystery event tomorrow. all these reporters have flown out there. so they have got to deliver they have to come out with that dazzling show me red dress, and if they don't the stock will sell off.

4:55 pm

people will be up set there is a lot of speculation about what the service may be, music sharing can be an on-line search, video ad, maybe even a smart phone but what is perform for shareholders to listen for. >> you're right there has been a ton of speculation about what exactly this is going to be. but really ultimately it's all about the money. they have to start to show us that they can deliver on the money side. that's been the big criticism on facebook is yeah, that is great that you have all these active users on mobile but how are you going to make money off of them. so that's the thing. no more charts about active users. we want to see where the money going to come from so one of the things that we're hearing is it could be that they have enhanced this messenger program so that say if i'm here at the nasdaq, i check in and there are restaurants around there and there is maybe a store and the advertisers pay big money for this, so that could tight in to yes, they need a mobile enhanced product. and advertising money so that could play into all of

4:56 pm

that. >> the word for facebook tomorrow may be monday at thisization, whatever is that is announcement will be. a six month high sounds impressive, below that tonight but still 20% ble that ipo price of $38. >> that's right, as i mentioned the stock has traded down because the market has been very unimpressed about what mark zuckerberg has delivered so far. this they don't come through tomorrow that stock will selloff because you saw a lot of buying up. and you know buy ahead of the new, sell on the news. if they do deliver and it's a great product, it's a wow day, then you could see the stock start to go back to that ipo number. >> tom: it is almost as important as that ipo day. >> it is very important because this is like an apple moment to. make this big announcement that come see what we are building, you know, they really built a lot of anticipation. and you know if you going to build that anticipation you've got to deliver. >> dow own shares? >> no, but i do have a

4:57 pm

facebook page. >> debra borchardt with the street.com. >> susie: and finally tonight, heavy rains over the weekend, are brightening the prospects for shippers on the mississippi river. the shipping super-highway has been closed because of a severe drought. low water has squeezed the flow of billions of dollars worth of cargo, like grain, oil and coal, on the nation's busiest river. but now the mississippi river could re-open in two weeks thanks to lots of rain across the mid-west. >> tom: lots of good news for those folks in the midwest, certainly. >> susie: that's "nightly business report" for monday, january 14. have a great evening everyone, and you too tom. >> tom: goodnight susie, we'll see you online at: www.nbr.com and back here tomorrow night. captioning sponsored by wpbt captioned by media access group at wgbh access.wgbh.org

178 Views

IN COLLECTIONS

KRCB (PBS) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11